The budget announcement in March included the biggest shake-up in pensions for over a decade, with the removal of the Lifetime Allowance tax charge and an increase in the Annual Allowance. These changes became law in July when the Finance (No. 2) Act 2023 received Royal Assent.

The Lifetime Allowance sets the total value of all the pension savings you can build up before having to pay extra tax. It had been expected to remain at its previous level of £1,073,100 until 2026, but the Chancellor announced plans to abolish it altogether from 6 April 2024, with the tax charge removed from 6 April 2023. It’s important to note that the maximum tax free lump sum that can be taken will still be based on 25% of the standard Lifetime Allowance.

The Annual Allowance limits the amount you can pay into your pension savings in a tax year without having to pay an additional tax charge. The standard Annual Allowance has been increased from £40,000 to £60,000. There have also been increases in the special annual allowances which apply for certain high earners and individuals who have already accessed some of their pension savings in a particular way.

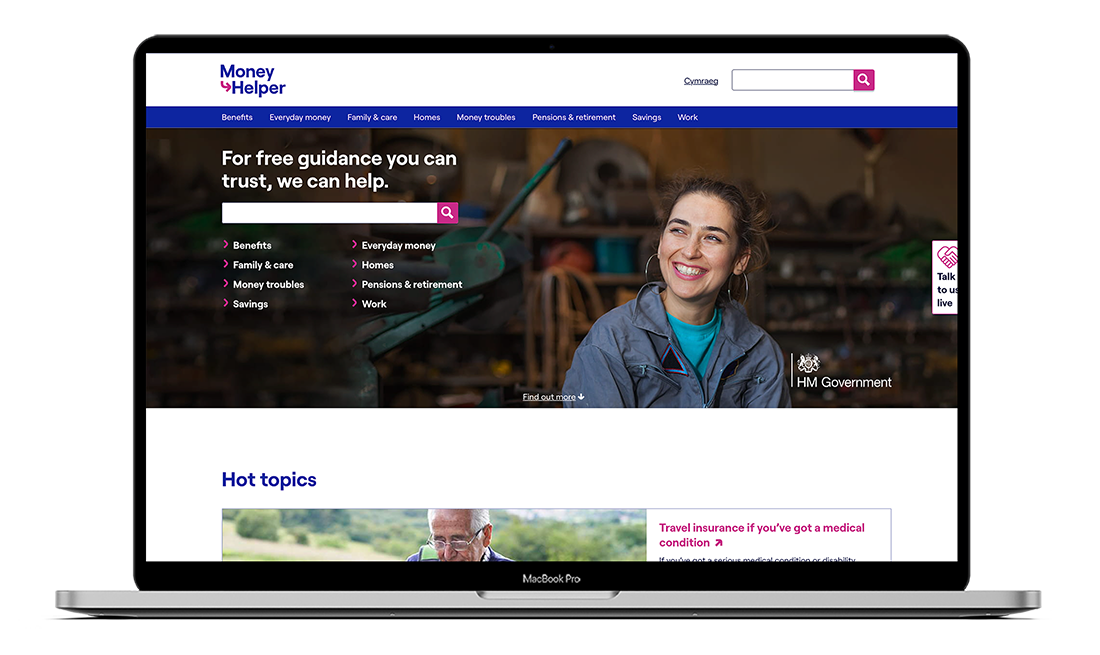

As ever, if you’re making decisions about your financial future, we recommend getting independent help and advice, especially if you think you may be affected by any of the tax changes announced as part of the budget. MoneyHelper is an excellent place to start. It can also help you to find an authorised independent financial adviser (IFA) in your area.